https://givingcrowd.co/wp-content/uploads/2024/08/Getty-2151658572_copy.jpg

1080

1920

Richard Blackmon

https://givingcrowd.co/wp-content/uploads/2017/07/TGC_Color.png

Richard Blackmon2024-08-01 21:04:132024-09-16 21:02:01Tips for Non-Cash Donations to Your Organization

https://givingcrowd.co/wp-content/uploads/2024/08/Getty-2151658572_copy.jpg

1080

1920

Richard Blackmon

https://givingcrowd.co/wp-content/uploads/2017/07/TGC_Color.png

Richard Blackmon2024-08-01 21:04:132024-09-16 21:02:01Tips for Non-Cash Donations to Your OrganizationBLOGS

All Blog Articles

https://givingcrowd.co/wp-content/uploads/2024/08/Getty-2151658572_copy.jpg

1080

1920

Richard Blackmon

https://givingcrowd.co/wp-content/uploads/2017/07/TGC_Color.png

Richard Blackmon2024-08-01 21:04:132024-09-16 21:02:01Tips for Non-Cash Donations to Your Organization

https://givingcrowd.co/wp-content/uploads/2024/08/Getty-2151658572_copy.jpg

1080

1920

Richard Blackmon

https://givingcrowd.co/wp-content/uploads/2017/07/TGC_Color.png

Richard Blackmon2024-08-01 21:04:132024-09-16 21:02:01Tips for Non-Cash Donations to Your Organization

Make Some Lemonade in These Stressful Times!

We all know the phrase “cash is king”, but what does that mean in the midst of stressful times such as we are now experiencing with COVID-19?

The Dark Underbelly of Wealth, and How to Save Your Kids from It

The desire to bless our children, is God-given, but without careful thought can sometimes backfire. There’s a point where passing down wealth can cause irreparable damage to your children’s lives. When we speak about estate plans, there’s a lot at stake.

The Fallacy of “Just Work Harder”

The tax benefits for Americans who give to your nonprofit or ministry are broad and substantial, despite the recent tax reform. Here’s the part of the story you’re just not hearing about from the major outlets.

Millennials, Online Giving, & Asset-Based Giving: How It All Ties Together

Vanco Payment Solutions recently published their Churchgoer Giving Study: Findings Report. While delivering some sobering news, there are seeds of opportunity for the future.

The Lifestyle Finish Line: When Is Enough… Enough?

The most important conversations are the hardest ones to have. Nowhere is this truer than in conversations around finances, generosity, and contentment. That’s why an objective third-party stewardship professional is critical to engaging your donors on these topics.

Donor Advised Funds for Churches

Last week, we talked about the rising popularity of donor-advised funds—but should pastors and church leaders be pushing this as a financial tool for their people? Absolutely.

Donor Advised Funds: The Best Financial Tool for Consistent Generosity

Too many people live reactionary lives, tossed around by the latest round of circumstances life throws at them, especially when it comes to their giving. But there’s an easy way to get control of your giving—donor-advised funds!

The Time for Change is Now

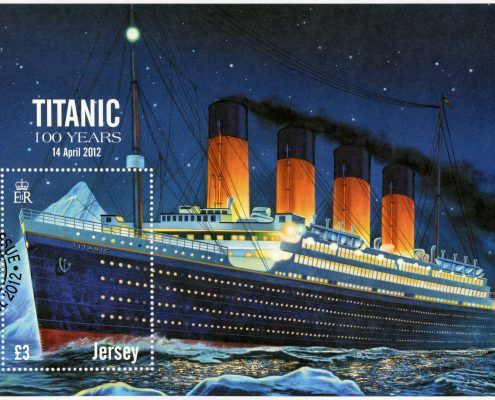

No matter how explicit or urgent the warnings may be, we human beings have a tragic history of ignoring what the facts are telling us. Don’t be the leader who runs your organization into the iceberg. You can rescue the ship now.

Where to find us

The Giving Crowd

P.O. Box 795001

Dallas, TX 75379

(972) 850-9503

info@givingcrowd.co

Latest Blogs

Tips for Non-Cash Donations to Your OrganizationAugust 1, 2024 - 9:04 pm

Tips for Non-Cash Donations to Your OrganizationAugust 1, 2024 - 9:04 pm Make Some Lemonade in These Stressful Times!March 26, 2020 - 1:00 pm

Make Some Lemonade in These Stressful Times!March 26, 2020 - 1:00 pm

Tips for Non-Cash Donations to Your Organization

in Donor RelationsThe average American has 9% of their net worth in cash. The other 91% is in non-cash assets. Yet 99% of all the efforts in cultivating charitable giving are chasing the 9%. This reality limits the potential of a nonprofit organization, higher education institution, or charity to achieve its mission and it robs the donor of the opportunity to have the greatest impact through their philanthropy.